High prices and a limited number of homes for sale have been the hallmarks of the Washington area’s housing market for years. Even as other markets nationwide have experienced increases in the number of homes for sale and slowing price increases, the capital region remains a seller’s market in many neighborhoods.

“The things that have been driving the market so far this year aren’t changing, so this fall we’ll see more of the same in the regional housing market,” says Chris Finnegan, vice president of marketing and communications for Bright MLS.

Those driving forces, Finnegan says, include low mortgage rates, strong employment and the Amazon effect, referring to the choice of National Landing in the Crystal City and Pentagon City areas of Arlington County, Va., for Amazon’s second headquarters.

The region is economically healthy because of the strength of the local labor market, says Terry Clower, director of the Center for Regional Analysis at George Mason University, but, he points out, there’s nothing more hyperlocal than the housing market.

“Even when you have buyers looking for a quality school district, they go beyond that to look for a house within the catchment area of a particular school,” Clower says. “There can be wide variations on home prices within adjacent neighborhoods because of the desirability of a particular school.”

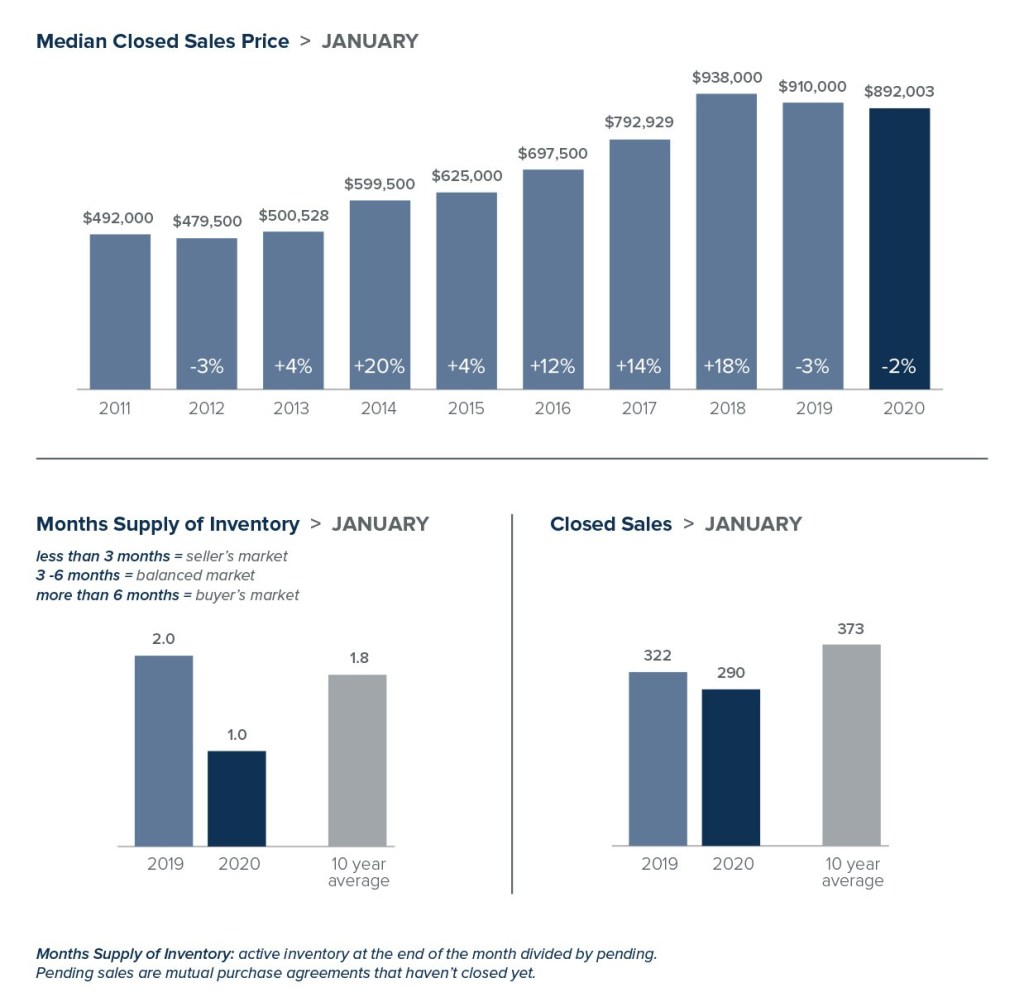

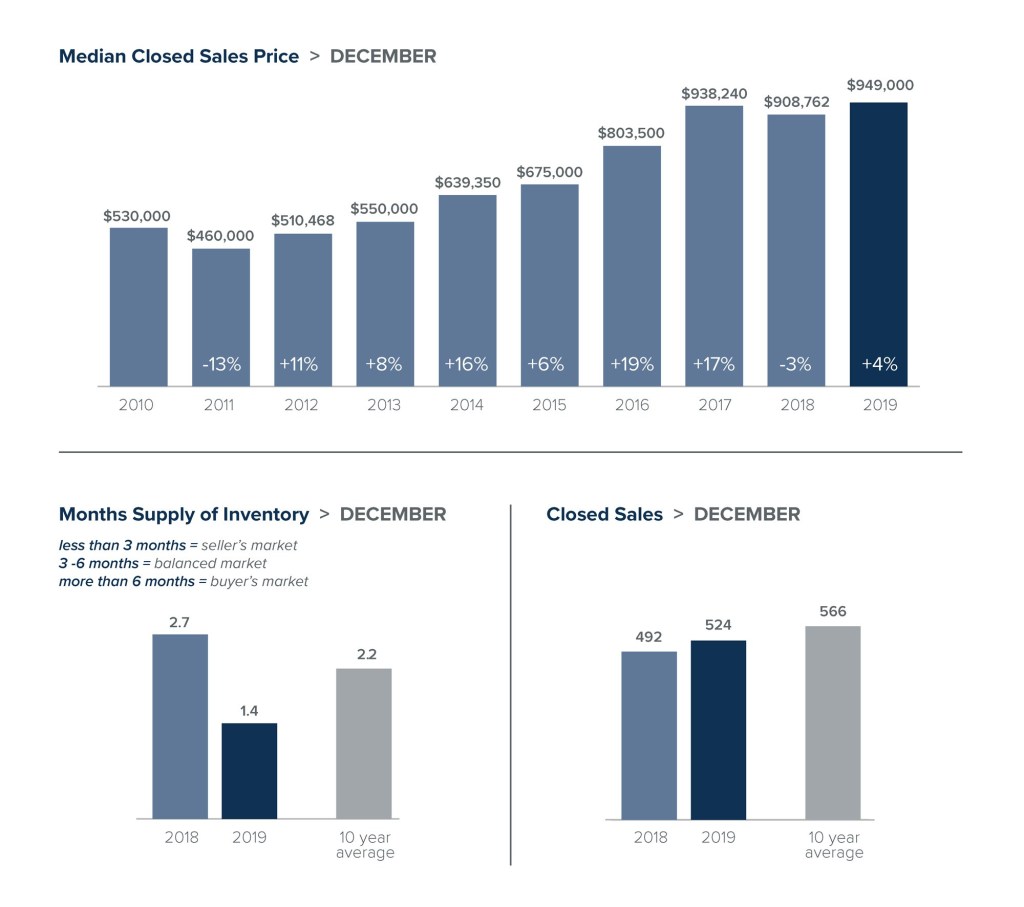

At the end of 2018, the regional housing market was affected heavily by a partial government shutdown, stock market volatility, and mortgage rates that were above 4.5 percent and anticipated to rise, says Ben Sage, director of the Mid-Atlantic region for Metrostudy, a housing market research and consulting firm.

“Since then, those hindrances to the housing market have mostly been resolved,” Sage says. “The government reopened and the stock market stabilized, although it’s suffered again lately. Most importantly, mortgage rates dropped down below 4 percent again and are anticipated to stay low.”

Recession fears have roiled the stock market in recent weeks, but Finnegan doesn’t anticipate a recession harming the regional housing market anytime soon, particularly not this fall.

“The supply of homes is extremely low, and what’s on the market goes for premium prices,” Finnegan says.

Low mortgage rates have pushed home sales higher than anticipated this year, Clower says, because rates were expected to be higher. Lower mortgage rates reduce monthly interest payments and can help people qualify for a larger mortgage or feel more comfortable buying a slightly more expensive home.

Tale of three markets

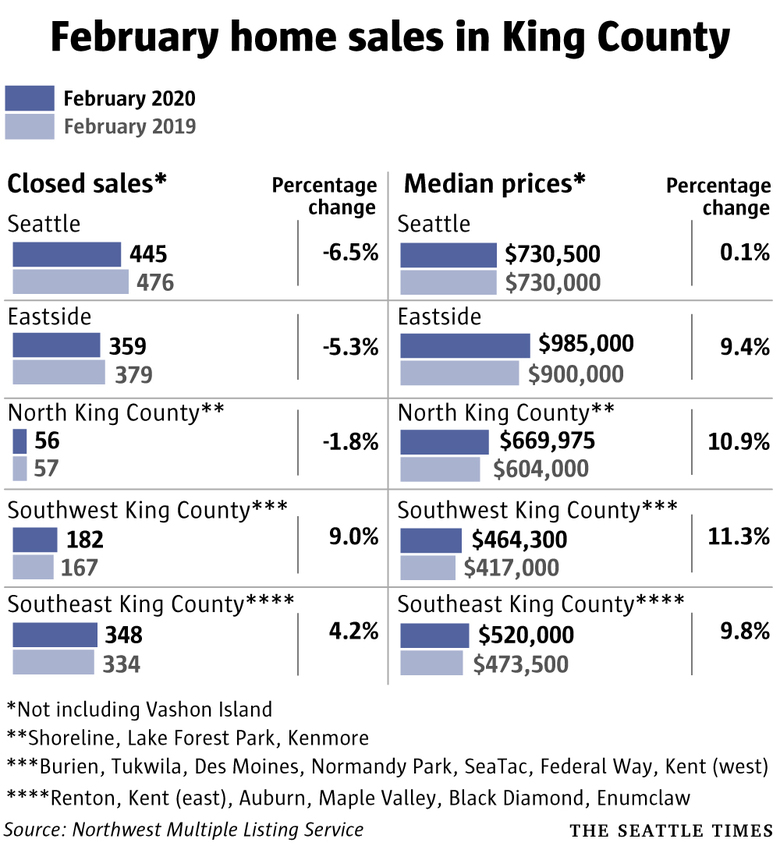

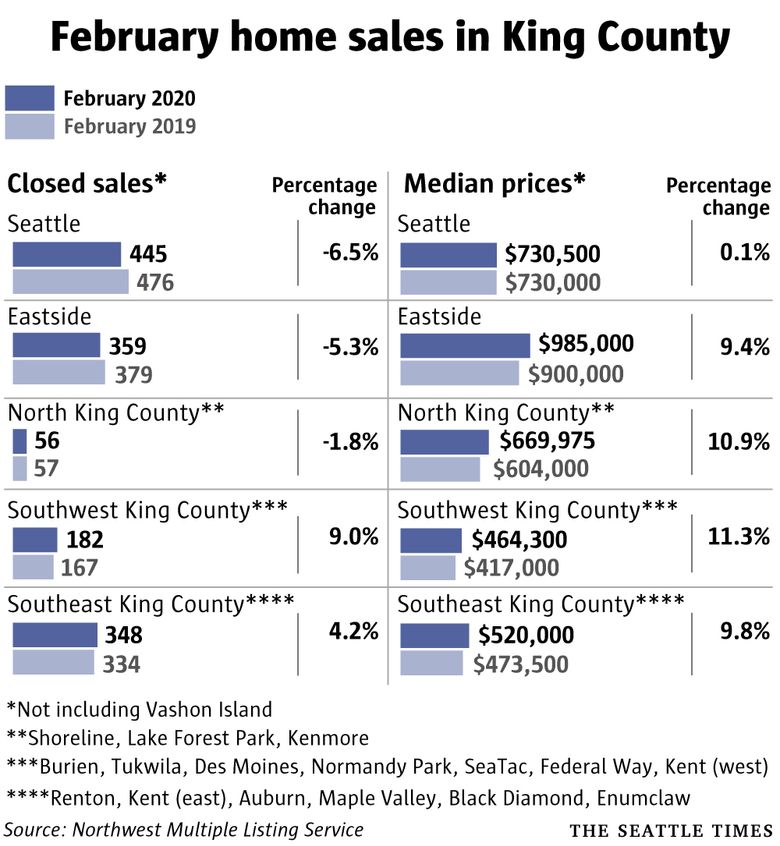

Although the housing market across the area is experiencing increasing prices, tight inventory and a steady pace of sales, there are differences in every county and neighborhood. Low inventory continues to plague the District and Northern Virginia, Finnegan says, while in Maryland, inventory shortages are less pronounced.

“The District is an evergreen, blue chip market,” Finnegan says. “Condos in the city are selling fast because employment numbers are good and mortgage rates are low. First-time buyers are eager to get into the market.”

The median sales price in the District climbed to $592,500 in July, up 4 percent over July 2018, according to the Greater Capital Area Association of Realtors. However, the number of homes sold in the District dropped by 6.8 percent in July compared to July 2018, in part because of continued lack of inventory, which was 1.3 percent lower this July than it was last July. As an indication of the competitiveness of the District’s housing market, the average ratio of the sales price to the original list price was 99.4 percent in July.

Finnegan says that in Maryland, the strongest markets for first-time buyers are in Silver Spring in Montgomery County and in Prince George’s County because both areas have more affordable housing. In Prince George’s, perennially the most affordable in the region, the median sales price rose to $320,000 in July, a jump of 12.3 percent over July 2018, according to Bright.

“In Silver Spring and a lot of areas of Prince George’s County, you’re close to everything but you can get more house for your money than in the District or other suburbs,” Finnegan says.

Northern Virginia, Finnegan says, is “on fire because of Amazon.” (Amazon founder Jeff Bezos owns The Washington Post.)

Although the Amazon effect is most intense in the area surrounding National Landing, the site of Amazon’s HQ2 headquarters, the Northern Virginia region also experienced a tightening market. The number of active listings declined by 31 percent in July compared to July 2018, according to the Northern Virginia Association of Realtors. The average days on the market dropped by 35 percent, from 49 days in July 2018 to 32 days in July 2019. The median sales price rose by 1.45 percent in Northern Virginia, to $542,750.

A recent analysis by Redfin found that the two most competitive markets in the country for buyers are Alexandria and Arlington, adjacent to the new Amazon headquarters. In both locations, Redfin’s report says, the number of homes for sale fell by about 50 percent in July 2019 compared to July 2018. Homes that sold in July 2019 went off the market in a median of 11 days in Arlington and 24 days in Alexandria, far faster than the median of 27 days in the region and the 38-day national median.

“Homeowners in Arlington and the Zip codes around the Amazon headquarters are holding onto their properties to see how high values will go,” Finnegan says. “Those who do choose to sell now are asking higher prices and getting them because of the shortage of homes for sale.”

The Amazon effect is likely to have a domino effect as employees are hired, Sage says.

“Some families will prioritize schools and space and move to the best school districts, so we’re likely to see more competition in Fairfax County, Loudoun County and even Montgomery County,” Sage says.

Clower says some new Amazon hires are likely to move into the District, especially if they’re single and want an urban environment. He says the Amazon decision should have a ripple effect and encourage more tech companies to locate to the region.

“Another good impact is that this has called even more attention to the need for affordable housing in the area,” Clower says.

New construction

Increasing density with mid-rise and high-rise condos as well as townhouses and stacked condos that look like townhouses is likely to be part of the mix of new housing in the District and surrounding suburbs to address the need for more housing as well as affordability, Sage says.

“More construction is needed to address the limited inventory among existing homes and also because some listings that are available don’t match what people want,” Sage says. “New homes offer fresh floor plans, low maintenance and allow some level of personalization.”

The areas with the most new construction in the D.C. region are Prince George’s County, Anne Arundel County and Frederick County in Maryland.

“There’s just not as much land in Northern Virginia compared to those Maryland counties,” Sage says.

One trend Sage has identified is that home buyers are more sensitive to being closer to where they work.

“The old ‘drive until you qualify’ mentality is less common, which is why you see more people willing to compromise and either continue to rent or to buy a townhouse or condo rather than move farther out,” Sage says.

Clower says that although larger houses still sell, there’s a shift in consumer preferences.

“The big home on a large lot near public transit is not a hot market,” Clower says. “In every pocket of the region, we’re starting to see more opportunities for a variety of housing, including high-rise buildings, townhouses and traditional single-family homes. The goal is to build homes that are accessible and affordable to people in different phases of their lives.”

To read original article on The Washington Post, click here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link